THE HOUSING MARKET – SNAP SHOT OF LAST WEEK….

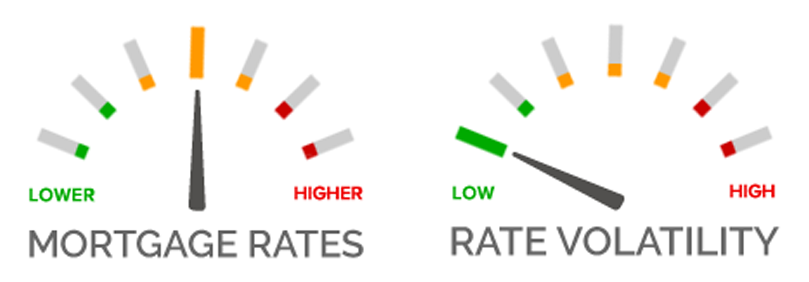

The labor market remains strong, even though jobless claims last week came in higher than expected supporting a likely Fed policy rate increase this month. In addition, the European Central Bank has shown confidence in the overseas economy and inflation. A strong global economy can pressure mortgage rates higher this year, resulting in new home prices that are likely to be pushed higher as builder costs increase.

Lumber prices are up 25% over the same time last year. Homebuyers are demanding more from their homes, including two-car garages, granite countertops, walk-in closets – all features which in the past were considered “upgrades”, are now often cited as “essential” home features. Looming on the horizon is the issue of the new tariffs on steel that could drive up the cost of building apartment buildings and condos. Although this scenario is still uncertain as to how it will play out, single-family homes, made of wood, are less likely to be affected. Real estate remains a premier investment in these times.